Notes: Venture Capital Workshop

Today, I had an opportunity to attend a workshop on Venture Capital conducted by INSEAD Prof. Henning Piezunka. I loved his openness and the unique examples he gave to explain the points. Overall, the workshop was very thought-provoking and gave an insider view of the VC.

During this workshop, I made notes which I am sharing hoping that these would help others as well. Following are the points which were most striking to me.

-

Types of Learning:

1. Stealing:

Deploying what is discussed the next time you are working

2. Inspiration:

The discussion triggers an idea that you can use

3. Oyster:

The discussion helps you to change but requires a lot of tweaking before it can be implemented.

4. Discomfort:

The discussion is intriguing but you don’t fully understand/know about it.

- The best way to predict the future is to create it. The second best way is to finance it.

- Your business is not in isolation. You need to be aware of your competition.

- We now have fewer IPOs compared to earlier times because companies can easily raise money privately. For example, Uber could raise $5M from Goldman Sachs in quite a small amount of time.

- VCs have skewed returns on investment.

- VC is about having asymmetric information.

- You need to have a brand when there is more supply than demand.

- Understanding both perspectives is very helpful irrespective of which side of the table you are.

- A good VC attracts ventures like a magnet.

- There are two ways to get good ventures: Fishing, Hunting

- The best way to get invited to a party is to host a party.

- It happens that the founders are sometimes replaced because VCs think that the founders could take the company from 0 to 1 but they can’t take it from 1 to 100 which is bad for founders. So to lure them, VCs invest in founder-led companies to show the founders that they will keep them in place.

- Nothing attracts like success: VCs that are successful early on tend to remain successful.

- You need to have an image of success.

- Do not worry about attention “in general” — you need attention from the right people.

- Access to the right startups, founders is very important in VC. Therefore you will be largely hired for your network.

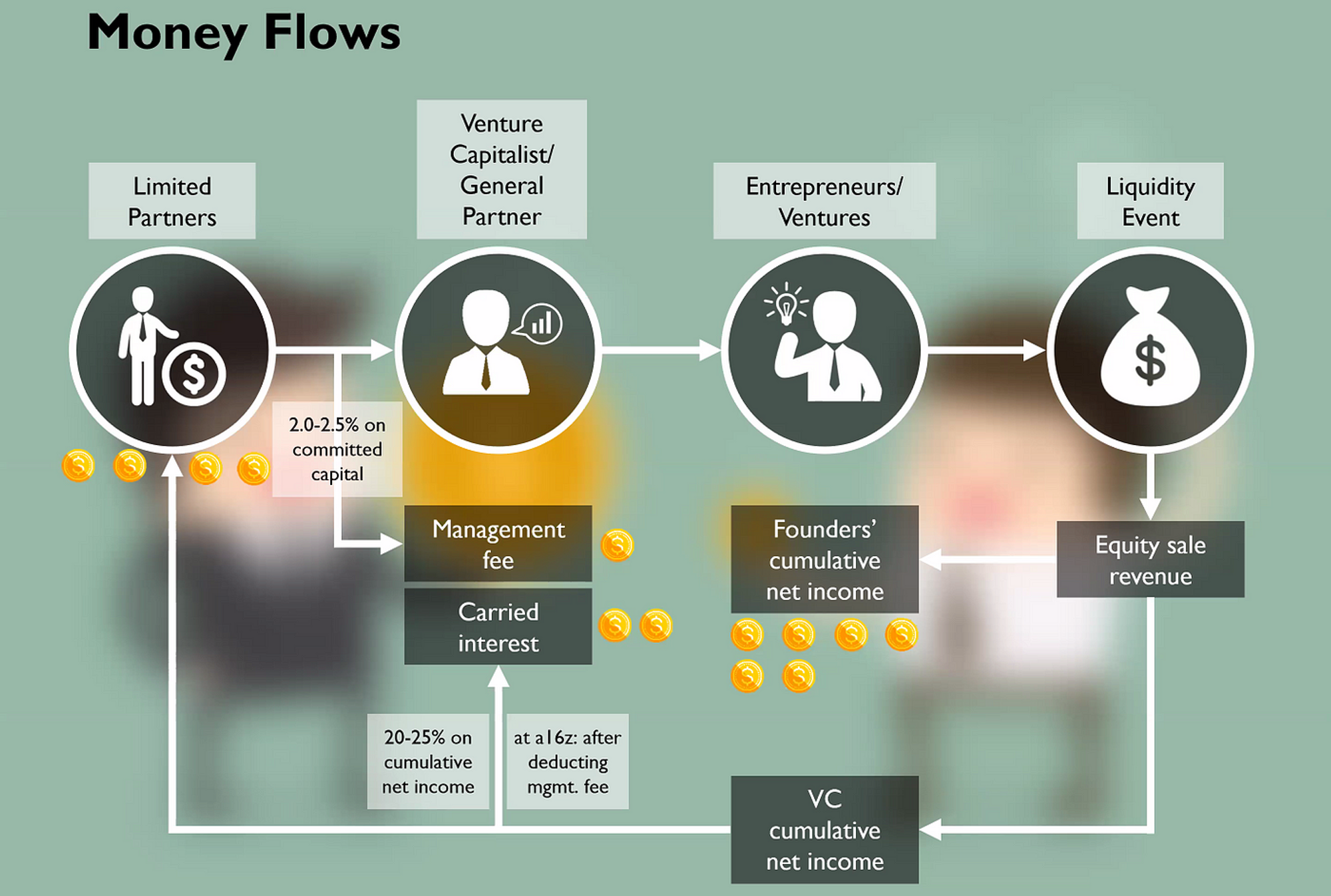

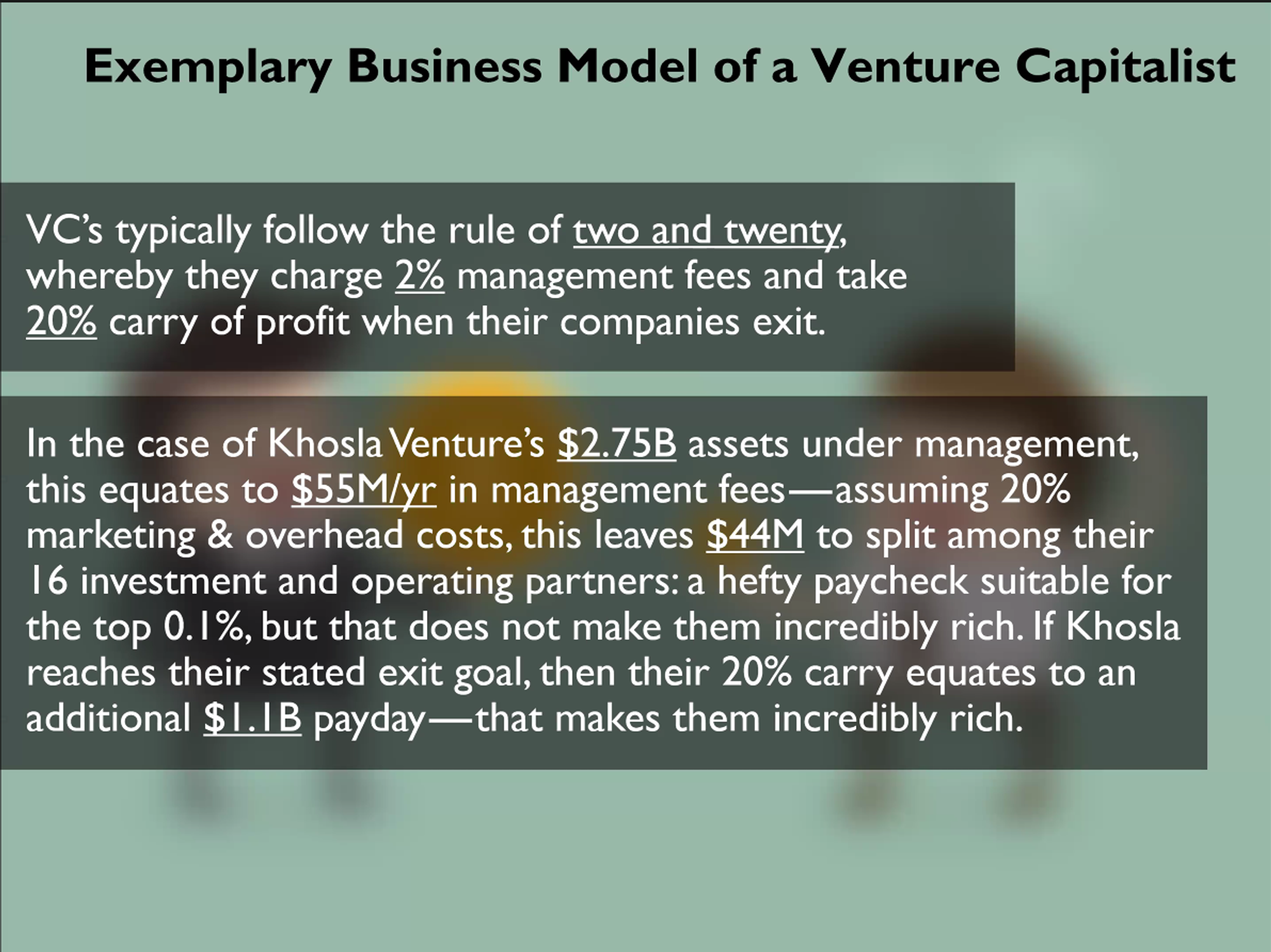

- From a profitability point of view, VC is the reverse of insurance. It banks on the fact that some of the startups will be so successful that they will outweigh the losses = Failing ventures but winning portfolios.

- To be a good VC, you have to be accurate and different.

- Contrarian Question: Write down something you believe to be true that most people believe to be false.

- People thinking that you are stupid when you are acting on a contrarian question is normal.

- It’s difficult to assess the health at an early stage.

- Consultants focus on macro domain whereas entrepreneurs focus on the micro level.

- The success of a company depends on if there are customers and are they happy.

- Sustainable advantage of a company must be:1. Valuable2. Rare3. In-imitable4. Non-substitutable

#startups #vc